Trading

How To Find the BEST Entry Zones (Smart Money Doesn’t Chase Price)

Most traders lose money not because their direction is wrong, but because their entry is trash. They buy the top of a green candle.They sell the bottom of a red one.And then they blame indicators, news, or “bad luck”. Smart money plays a different game. They don’t ask “Where will price go?”They ask “Where is […]

The Unexpected Laws of Personal Finance

Lessons Inspired by Morgan Housel Personal finance is often taught like a math problem—earn more, spend less, invest wisely, and everything will fall into place. But real life refuses to behave like a spreadsheet. People with high incomes go broke, while modest earners quietly build massive wealth. Markets reward patience one year and punish intelligence […]

The 1% Trap: Why Your Financial Advisor Might Be Costing You $700,000

A 1% annual fee sounds small. On a mortgage it would be junk change. But invested over decades, that single percentage point compounds into real money—sometimes hundreds of thousands of dollars. This article explains exactly how the “1% trap” works, shows concrete math (so you can’t misremember the scale), summarizes what advisors do that can […]

Bitcoin: How to find the Bottom

Bitcoin is in a deep correction phase after reaching record highs above ~$125,000 in late 2025. Prices have fallen sharply — dipping below ~$63,000–$65,000 before partial rebounds. The broader crypto market has shed roughly $2 trillion in value, wiping out many post-election gains. Sentiment is weak and institutional flows have turned negative, with U.S. Bitcoin […]

The Financial Crisis of 2026: Economists Sound Alarm Bells

Why Economists Are Worried About 2026 As the global economy enters 2026, an increasing number of economists, market strategists, and policy experts are warning that the world may be approaching a new financial crisis. Unlike the 2008 collapse, which was sudden and banking-centric, the Financial Crisis of 2026 is shaping up as a slow-building structural […]

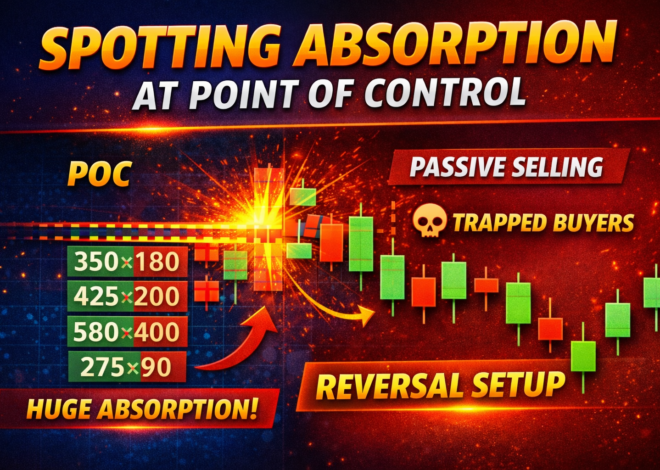

Spotting Absorption at Point of Control (POC)

1. Introduction In auction-based trading, the Point of Control (POC) represents the price level where the highest volume traded during a defined session or range. Because large traders prefer operating at value-heavy zones, the POC often becomes a battlefield between buyers and sellers. When absorption occurs at POC, it signals that passive liquidity is overpowering […]

Large Lot Tracker: Smart Money Identification in Footprint

In Orderflow trading, the biggest edge is identifying where smart money enters the market.Price doesn’t move because retail traders buy or sell—price moves when large orders hit the market. A Large Lot Tracker is a critical footprint concept that exposes: This is one of the highest-accuracy smart money detection tools inside the footprint chart. 🎯 […]

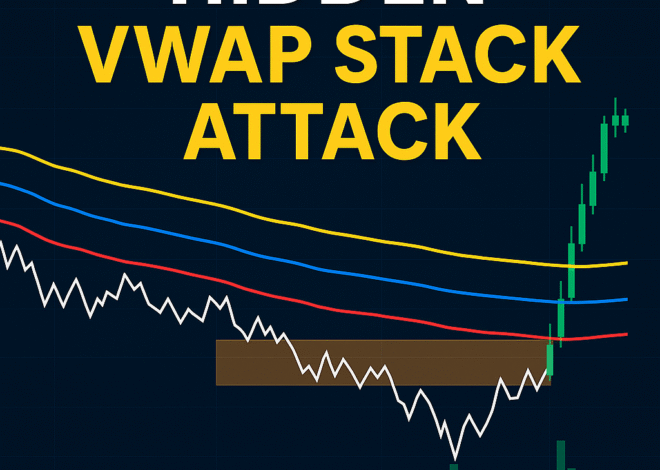

Hidden VWAP Stack Attack — A deep dive, tactics, and trade plan

The Hidden VWAP Stack Attack is a short-term intraday tactic that seeks edges where multiple VWAP anchors (session VWAP, anchored VWAPs, rolling VWAPs) line up (a “stack”), then uses price behaviour (liquidity sweeps, micro structure, volume spikes, order blocks) to enter on the ensuing move when institutions or algos “attack” that stacked fair-value shelf. You […]

Trading the Fractal: Multi-Timeframe Synchrony Beyond Basic Levels

Markets are not random — they are fractal systems, repeating the same patterns on every scale.The price behavior on a 5-minute chart often mirrors what happens on a daily chart — just compressed in time and amplitude. This concept, called market fractality, is central to mastering multi-timeframe analysis — where true synchrony between timeframes can […]