Difference Between Footprint vs Traditional Candlesticks

🟩 1. Introduction

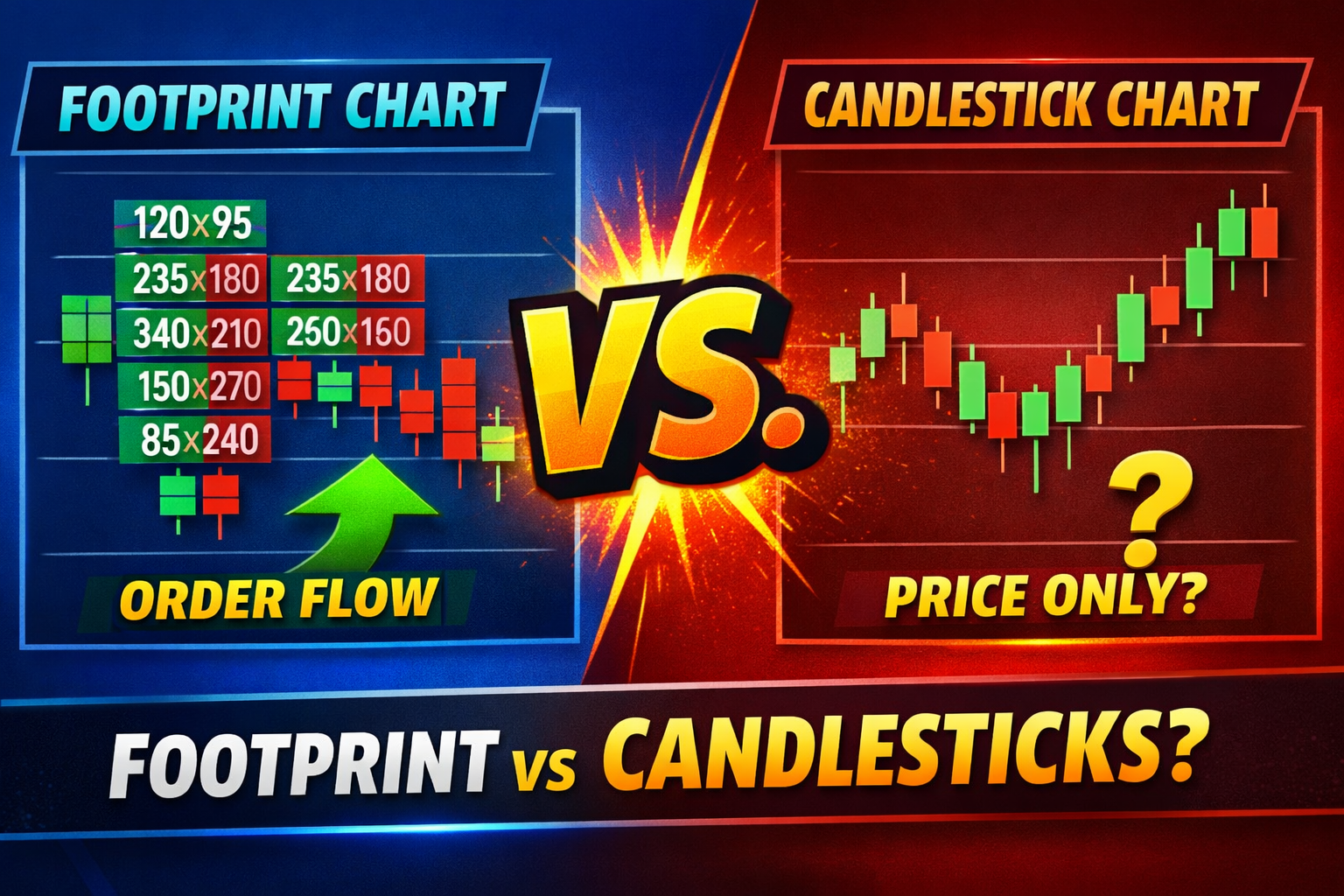

Most traders begin with traditional candlestick charts because they show price movement in a simple visual form. However, as traders evolve, they seek more context — especially about who is buying, who is selling, and how aggressively.

This is where the Order Flow Footprint chart becomes a major upgrade.

🟦 2. What Traditional Candlesticks Show

Traditional candles show only four price points:

- Open

- High

- Low

- Close

Plus color for bullish/bearish sentiment.

They tell you what price did, but not how and why price moved.

Limitations of Candlesticks

Candles do not show:

❌ who initiated the move (buyers or sellers)

❌ how much volume traded at each price

❌ whether breakout is real or fake

❌ whether buyers are trapped or sellers are trapped

❌ if institutions absorbed or initiated orders

This lack of internal data is why most breakouts fail and beginners get trapped.

🟥 3. What Footprint Charts Show

Footprint charts display actual order flow at every price level, showing:

✔ Volume traded

✔ Bid x Ask distribution

✔ Delta (net buying vs selling)

✔ Imbalance (aggressive buyer/seller dominance)

✔ Absorption (big passive orders stopping price)

✔ Trapped traders

A typical footprint candle may show something like:

120x95

235x180

340x210

150x270

This means at each price level, how many contracts were executed:

Bid x Ask = Sellers (Aggressive) vs Buyers (Aggressive)

🟨 4. The Key Difference: Context vs. No Context

| Feature | Candlesticks | Footprint |

|---|---|---|

| Price O/H/L/C | Yes | Yes |

| Volume Total | Only total | Shows volume per tick |

| Bid x Ask | No | Yes |

| Delta | No | Yes |

| Imbalance | No | Yes |

| Absorption | No | Yes |

| Trapped traders | No | Yes |

| Bull/Bear Strength | Guessing | Measurable |

| Institutional Activity | Invisible | Detectable |

| Execution Signals | Weak | Strong |

| Breakout Confirmation | Poor | Reliable |

In short:

Candles show price movement. Footprint shows the reason behind the movement.

🟧 5. Footprint Helps With Professional Questions

Pro traders care about:

✔ Who initiated the move

✔ Are buyers aggressive or passive?

✔ Is volume supporting breakout?

✔ Are institutions absorbing to reverse price?

✔ Are traders being trapped?

Candlesticks cannot answer these questions — footprint can.

🟪 6. Example: Breakout Scenario

Scenario: Price breaks resistance

- Candlestick view:

Price looks bullish → traders go long. - Footprint view:

Breakout shows: - weak delta

- no bid-ask imbalance

- high absorption at top

- sellers stepping in

Such breakouts usually fail → traders get trapped.

🟫 7. Example: Liquidity Sweep

On candlesticks:

- looks like a wick

On footprint:

- shows aggressive sellers got absorbed by big passive buyers

- reversal likely

This is the kind of microstructure edge pros use.

🟩 8. Use Cases — Who Should Use What

Candlestick is enough for:

✔ Beginners

✔ Swing traders

✔ Higher timeframes

✔ Visual pattern traders

Footprint is required for:

✔ Scalpers

✔ Day traders

✔ Futures traders

✔ Crypto orderflow

✔ Auction market theory

✔ Liquidity traders

✔ Smart money style traders

🟦 9. Why Footprint Improves Accuracy

Footprint increases accuracy because it shows effort vs. result.

- If price moves up with strong delta → trend valid

- If price moves up with negative delta → divergence → reversal likely

This helps to:

✔ avoid traps

✔ reduce false breakouts

✔ identify imbalance

✔ confirm entries

✔ time exits

🟥 10. Backtesting Reality

Candlestick indicators often lag.

Footprint signals are:

✔ real-time

✔ volume-driven

✔ non-lagging

✔ auction-based

Hence edge is execution speed + context, not prediction.

🟨 11. In One Line Summary

Candles tell you WHERE price moved.

Footprint tells you WHY price moved.

🏁 12. Conclusion

Traditional candlesticks are price-based, simple, and useful for beginners. Footprint charts are microstructure-based and useful for professionals seeking precision and true orderflow understanding.

If your trading requires:

- timing entries

- confirming breakouts

- reading institutional behavior

- detecting traps or absorption

then footprint becomes a powerful mandatory tool.