Spotting Absorption at Point of Control (POC)

1. Introduction

In auction-based trading, the Point of Control (POC) represents the price level where the highest volume traded during a defined session or range. Because large traders prefer operating at value-heavy zones, the POC often becomes a battlefield between buyers and sellers.

When absorption occurs at POC, it signals that passive liquidity is overpowering aggressive orderflow, and the market may be preparing for a reversal or continuation depending on context.

2. What is Absorption? (Quick Definition)

Absorption occurs when:

Aggressive buyers or sellers are “absorbed” by passive limit orders without meaningful price movement.

Example:

- Aggressive buyers hit the ask with size

- Price does not move higher

- Passive sellers absorb the volume

- Buyers become trapped → reversal likely

Absorption shows intent of smart money.

3. Why POC Matters for Absorption

POC is not just a volume node — it is a value agreement zone where:

✔ Institutions transact

✔ Rebalancing happens

✔ Inventory transfers occur

✔ Hedgers operate

When absorption shows up here, it tells us:

Someone is defending value at a critical level.

This makes the signal much stronger than absorption at random price points.

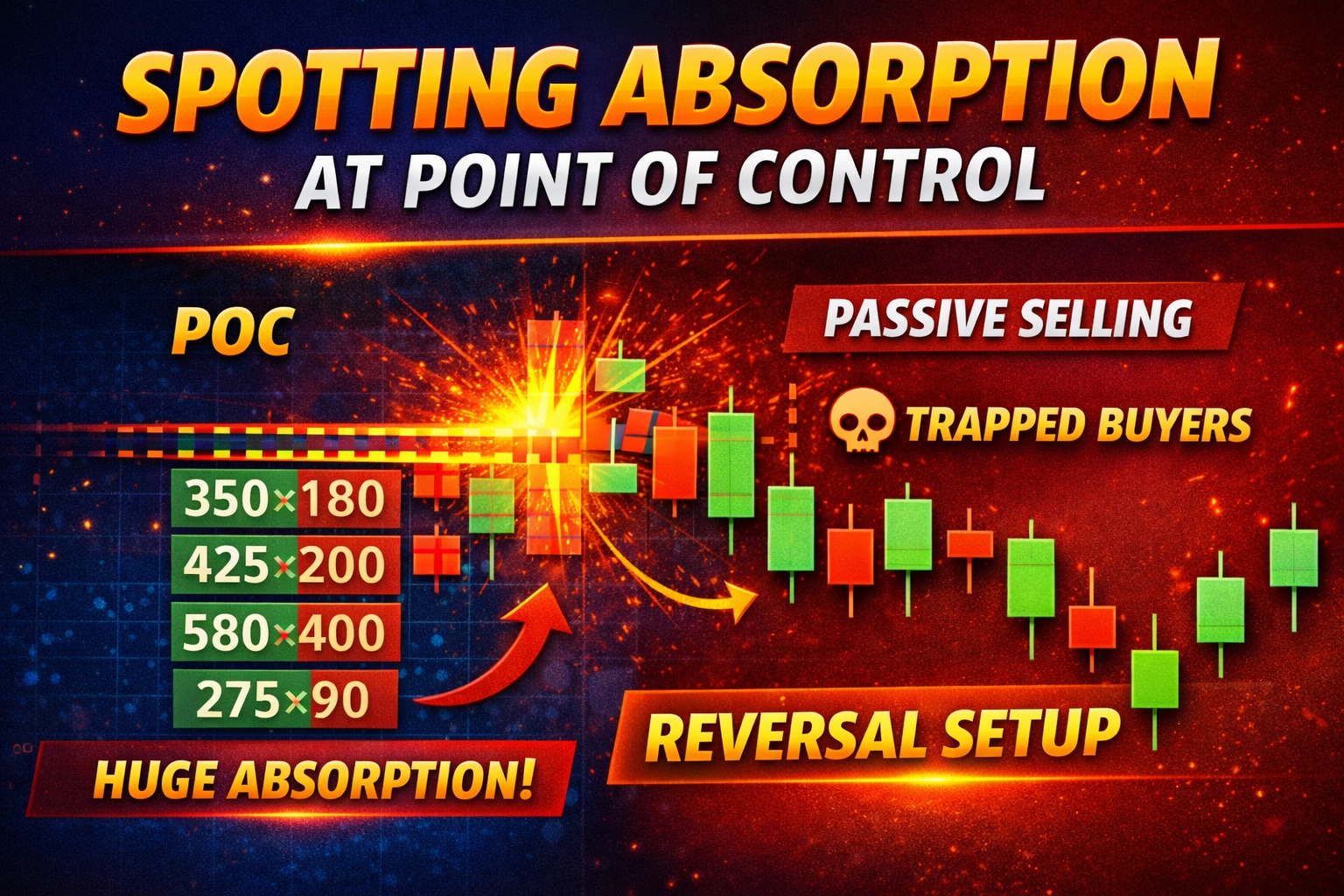

4. How Absorption Looks on Footprint Charts

Absorption typically shows as:

A. Large Bid/Ask volume stacking

But no price continuation.

Example footprint:

480x120

520x140

600x150

650x160

700x170

Huge buy imbalance but no price extension → buy absorption.

B. Large stacked delta with failure to follow through

If delta is rising but price isn’t → bullish effort failing.

C. Trapped aggressor behavior

Market pushes into POC but:

- fails to break through

- rotates back out

5. Context Checklist: When Absorption at POC Means Something

Absorption at POC becomes actionable when 4 conditions align:

- Price reaches POC

- Aggressive orders hit

- Passive liquidity absorbs

- Failed follow-through (no range expansion)

If these 4 align, expect rotation away from POC.

6. Two Scenarios: Bullish vs. Bearish Absorption

A. Bullish Absorption at POC (Buyers absorbing sellers)

Trigger signs:

- Sellers hammering bid

- Delta negative

- Price not dropping

- POC holds

- Rotation up

Implication: Continuation upward or breakout.

B. Bearish Absorption at POC (Sellers absorbing buyers)

Trigger signs:

- Buyers lifting ask

- Delta positive

- Price not advancing

- POC capped

- Rotation down

Implication: Reversal or rejection

7. Confluence Factors That Strengthen the Signal

POC absorption is stronger when it aligns with:

✔ VWAP

✔ Value Area High (VAH) / Value Area Low (VAL)

✔ Daily/Weekly POC

✔ Liquidity pools

✔ Order blocks

✔ Session open/close levels

✔ Big round numbers (example: 50/100/1000 levels)

8. Practical Playbook for Traders

Here’s a simple 3-step execution model:

Step 1 — Identify Absorption

Look for:

- high volume

- high delta

- no follow-through

Step 2 — Wait for Rotation Away

Let price prove the rotation; don’t try to predict.

Step 3 — Enter on Retest

Low-risk entry if price comes back to test POC with reduced aggression.

9. Stop-Loss & Target Logic

SL placement

Below/above absorption wick or just beyond POC depending on direction.

Targeting

POC absorption typically rotates back to:

✔ VAH/VAL

✔ Opposite distribution zone

✔ Opposite liquidity pool

10. Common Mistakes

❌ Entering before absorption is confirmed

❌ Ignoring higher timeframe POC alignment

❌ Assuming every POC is defended (it is not)

❌ Trading POC without reading delta

❌ Not waiting for rotation

11. Why This Works

Because absorption is a form of:

Inventory transfer between weak hands and strong hands.

The market often rotates after inventory transfer completes.

12. Simple Summary

Absorption at POC = Smart money defending value + trapping aggressors + setting up rotation.

It is one of the most reliable microstructure signals for:

✔ futures traders

✔ crypto scalpers

✔ liquidity traders

✔ volume profile traders